hotel tax calculator nc

The state sales tax rate in North Carolina is 4750. Sales Tax Calculator Sales Tax Table.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

. North Carolina NC Sales Tax Rates by City. Im not sure about that particular hotel but the last time I stayed in Raleigh in November 10 I had to pay NC sales tax 775 Occupancy tax 3 and city tax 3. Calculate your North Carolina net pay or take home pay by entering your per-period or annual salary along with the pertinent federal.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The North Carolina Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. North Carolina Salary Tax Calculator for the Tax Year 202223 You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202223.

Like hotel and BB stays short-term rentals in North Carolina are subject to tax. The North Carolina NC state sales tax rate is currently 475. Designed for mobile and desktop clients.

Depending on local municipalities the total tax rate can be as high as 75. The calculator should not. North Carolina Gas Tax.

County and local taxes in most areas bring the sales. North Carolina has a 475 statewide sales tax rate. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in North Carolina.

With local taxes the total sales tax. Gross receipts derived from the rental of an accommodation and the sales and use tax thereon are to be reported to the Department on Form E-500. 2 A state lodging tax is only.

Minimum Wage in North Carolina in 2021. Only In Your State. Usually the vendor collects the sales tax from the consumer as the consumer makes a.

To get the hotel tax rate a percentage divide the tax per night by the cost of the room before taxes. In North Carolina both long- and short-term capital gains are treated as regular income which means the 525 flat income tax rate applies. North Carolina Salary Paycheck Calculator.

FilePay Sales and Use Tax E-500 Pay a Bill. Tax authorities require short-term vacation rental hosts to collect applicable short-term rental taxes from their. In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes.

Avalara automates lodging sales and use tax compliance for your hospitality business. Please enter the following information to view an estimated property tax. Just enter the five-digit.

The act went into full effect in 2014 but before then North Carolina had. Ad Finding hotel tax by state then manually filing is time consuming. General Information Tax Rates Sales and Use Tax Forms and Certificates Technical Resources.

Answer 1 of 2. The Room Occupancy Tax of 1991 is six percent 6 and the Room Occupancy Tax of 2006 is two percent 2 of the monthly gross receipts from the rental of any room lodging or. Avalara automates lodging sales and use tax compliance for your hospitality business.

It is my understanding that in Raleigh lodging rooms are taxed at 135 475 state sales tax 225 county sales tax 6 county occupancy tax. Well do the math for youall you need to do is. Rentals of Hotel Rooms and.

Hotel Tax Calculator Nc. In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes. So if the room costs 169 before.

For comparison the median home value in North Carolina is. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill.

This calculator is designed to estimate the county vehicle property tax for your vehicle. Hourly non-exempt employees must be paid time and a. Ad Finding hotel tax by state then manually filing is time consuming.

Hotel Taxes in North Carolina.

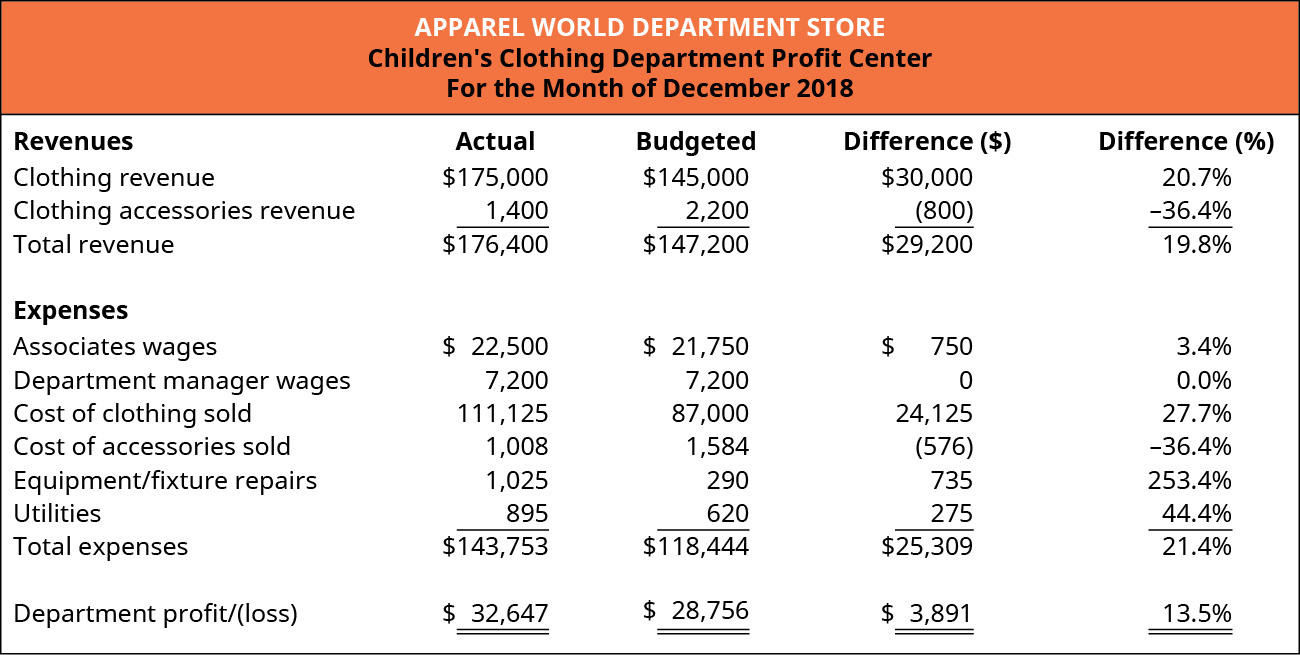

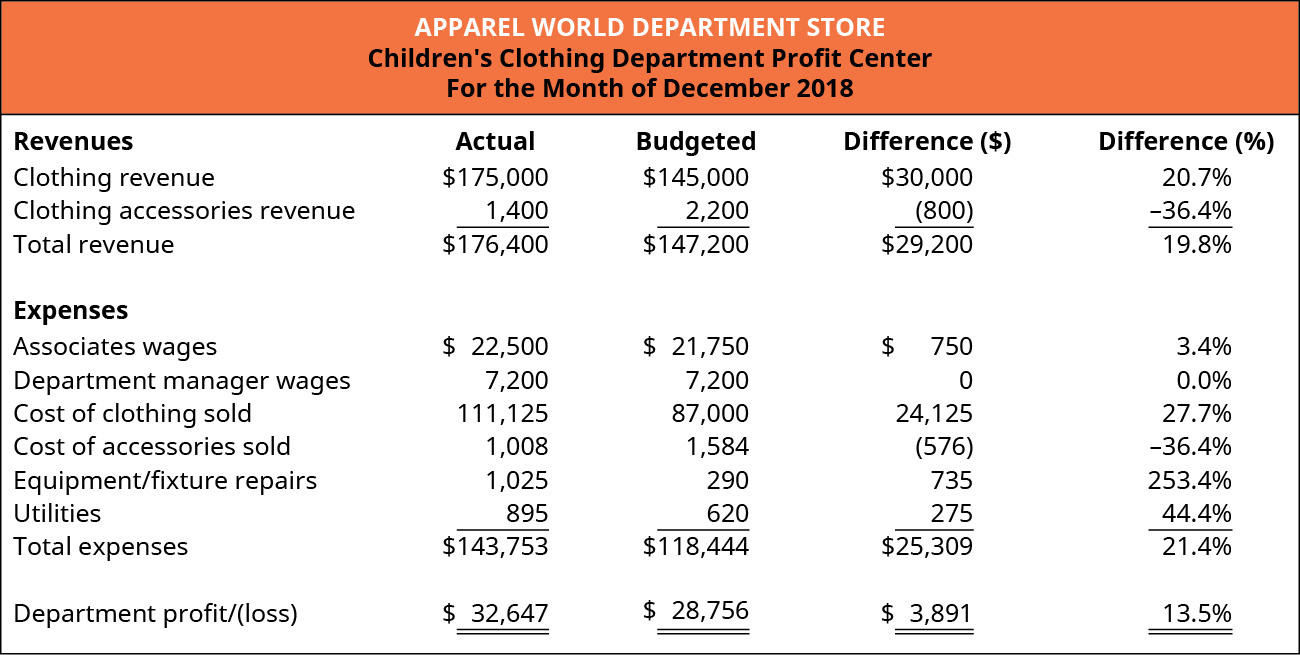

Describe The Types Of Responsibility Centers Principles Of Accounting Volume 2 Managerial Accounting

Office Of The Tax Collector City Of Hartford

Oregon Enacts Two New Local Income Taxes For Portland Metro Multnomah County Primepay

Avatax Net Client Library Available On Nuget

1 603 Price List Stock Photos Pictures Royalty Free Images Istock

State Auditor Salary Comparably

Business Licenses How Many Do You Need And How Do You Get Them

Taxfyle Com Tax Bracket Calculator Income Tax Brackets Tax Brackets Income Tax

5 Things Every Etsy Seller Needs To Know About Sales Tax

Avatax Net Client Library Available On Nuget

Property Garbage Macon Bibb Tax Commissioner

Avatax Net Client Library Available On Nuget

Decolonization As The Horizon Of Political Action Journal 77 November 2016 E Flux